gmocoin-backtest is a python library for backtest with gmocoin fx btc trade technical analysis on Python 3.7 and above.

backtest data from here

$ pip install gmocoin-backtest

from gmocoin_backtest import Backtest

class MyBacktest(Backtest):

def strategy(self):

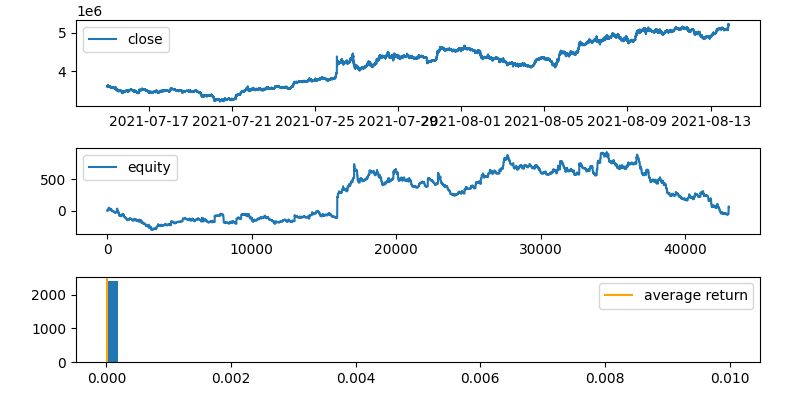

fast_ma = self.sma(period=5)

slow_ma = self.sma(period=25)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

MyBacktest(from_date="2021-07-15", to_date="2021-08-15").run()from gmocoin_backtest import Backtest

from pprint import pprint

class MyBacktest(Backtest):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

atr = self.atr(period=20)

lower = ema - atr

upper = ema + atr

self.buy_entry = (rsi < 30) & (self.df.C < lower)

self.sell_entry = (rsi > 70) & (self.df.C > upper)

self.sell_exit = ema > self.df.C

self.buy_exit = ema < self.df.C

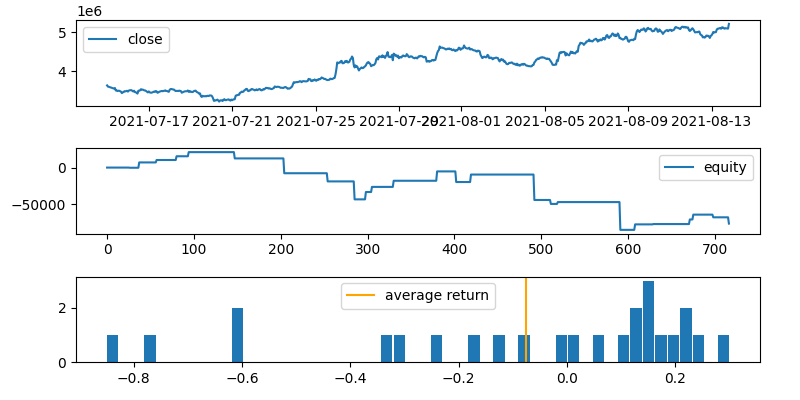

bt = MyBacktest(

symbol="BTC", # (default=BTC_JPY)

sqlite_file_name="backtest.sqlite3", # (default=backtest.sqlite3)

from_date="2021-07-15", # (default="")

to_date="2021-08-15", # (default="")

size=0.1, # (default=0.001)

interval="1H", # 5-60S(second), 1-60T(minute), 1-24H(hour) (default=1T)

data_dir="data", # data directory (default=data)

)

pprint(bt.run(), sort_dicts=False){'total profit': -76320.2,

'total trades': 25,

'win rate': 56.0,

'profit factor': 0.549,

'maximum drawdown': 105907.1,

'recovery factor': -0.721,

'riskreward ratio': 0.431,

'sharpe ratio': -0.226,

'average return': -0.075,

'stop loss': 0,

'take profit': 0}- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Stochastic Oscillator 'stoch'

- Average True Range 'atr'

class MyBacktest(Backtest):

def strategy(self):

macd, signal = self.macd(fast_period=12, slow_period=26, signal_period=9)

self.sell_exit = self.buy_entry = (macd > signal) & (

macd.shift() <= signal.shift()

)

self.buy_exit = self.sell_entry = (macd < signal) & (

macd.shift() >= signal.shift()

)class MyBacktest(Backtest):

def strategy(self):

upper, mid, lower = self.bbands(period=20, band=2)

self.sell_exit = self.buy_entry = (upper > self.df.C) & (

upper.shift() <= self.df.C.shift()

)

self.buy_exit = self.sell_entry = (lower < self.df.C) & (

lower.shift() >= self.df.C.shift()

)class MyBacktest(Backtest):

def strategy(self):

k, d = self.stoch(k_period=5, d_period=3)

self.sell_exit = self.buy_entry = (

(k > 20) & (d > 20) & (k.shift() <= 20) & (d.shift() <= 20)

)

self.buy_exit = self.sell_entry = (

(k < 80) & (d < 80) & (k.shift() >= 80) & (d.shift() >= 80)

)class MyBacktest(Backtest):

def strategy(self):

sma = self.sma(period=20)

ratio = (self.df.C - sma) / sma * 100

self.sell_exit = self.buy_entry = ratio > -5 & (ratio.shift() <= -5)

self.buy_exit = self.sell_entry = ratio < 5 & (ratio.shift() >= 5)class MyBacktest(Backtest):

def strategy(self):

mom = self.df.C - self.df.C.shift(10)

self.sell_exit = self.buy_entry = mom > 0 & (mom.shift() <= 0)

self.buy_exit = self.sell_entry = mom < 0 & (mom.shift() >= 0)class MyBacktest(Backtest):

def strategy(self):

high = self.df.H.rolling(20).max()

low = self.df.L.rolling(20).min()

self.sell_exit = self.buy_entry = (high > self.df.C) & (

high.shift() <= self.df.C

)

self.buy_exit = self.sell_entry = (low < self.df.C) & (

low.shift() >= self.df.C

)class MyBacktest(Backtest):

def rvi(

self, *, period: int = 10, price: str = "C"

) -> Tuple[pd.DataFrame, pd.DataFrame]:

co = self.df.C - self.df.O

n = (co + 2 * co.shift(1) + 2 * co.shift(2) + co.shift(3)) / 6

hl = self.df.H - self.df.L

d = (hl + 2 * hl.shift(1) + 2 * hl.shift(2) + hl.shift(3)) / 6

rvi = n.rolling(period).mean() / d.rolling(period).mean()

signal = (rvi + 2 * rvi.shift(1) + 2 * rvi.shift(2) + rvi.shift(3)) / 6

return rvi, signal

def strategy(self):

rvi, signal = self.rvi(period=5)

self.sell_exit = self.buy_entry = (rvi > signal) & (

rvi.shift() <= signal.shift()

)

self.buy_exit = self.sell_entry = (rvi < signal) & (

rvi.shift() >= signal.shift()

)